General instructions purpose of form use form n 342 to figure and claim the renewable energy technologies income tax credit retitc under section 235 12 5 hawaii revised statutes hrs.

Hawaii solar tax credit form.

2012 01 pdf temporary administrative rules relating to the renewable energy technologies income tax credit retitc.

Outline of the hawaii tax system as of july 1 2019 4 pages 59 kb 2 26 2020.

Use one form n 342 for each system.

Retitc forms shortcut to form n 342 and instructions form n 342a form n 342b and instructions and form n 342c and instructions.

The nice part about credit is that it combines with the federal solar tax.

Clear form state of hawaii department of taxation form n 342 rev.

1 income tax paid to another state or foreign country n 11 n 15 and n 70np filers attach copy of tax return s from other state s or federal form s 1116.

See tax return instruction booklet for more information.

Reference sheet with hawaii tax schedule and credits.

A summary of state taxes including information on tax rates forms that must be filed and when taxes must be paid.

2019 tax year renewable energy technologies income tax credit 2019 for systems installed and placed in service on or after july 1 2009 note.

The table below shows the value of the investment tax credit for each technology by year.

The expiration date for solar technologies and wind is based on when construction begins.

What is the solar tax credit in hawaii.

All or part of the credits and the revocation of the election to composite file.

Solar water heater tax credit 1.

As a result of sb 855 in 2003 the tax credits were revised and extended to the end of 2007.

As we ve discussed on the hawaii solar incentives page here at hawaiisolarhq the tax credit in the aloha state is 35 of the cost of the solar installation or 5 000 whichever is less.

Tax information release no.

Use a separate form for each eligible system and for carryover credit s.

The state of hawaii also offers at 50 75 rebate for solar attic fans via local utility companies.

An owner of real property that has a single family dwelling ohana dwelling farm dwelling duplex or double family dwelling unit s and who installs a solar water heater on the owner s property on or after january 1 2008 shall be entitled to a one time tax credit per tax map key of up to 300.

Lighting energy efficient lighting like leds use 85 less energy to produce the same amount of light as old fashioned incandescent light bulbs and can last up to 20 years.

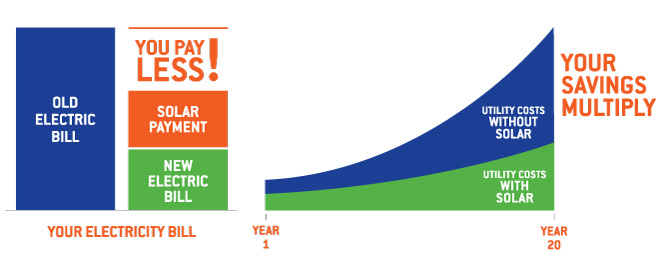

What s more with hawaii energy s rebate combined with state and federal tax credits you can save nearly 70 on the system purchase price in the first year.

Since originally enacted in 1976 the hawaii energy tax credits have been amended several times.